Follow The Money

Introducing Perdiem, and why transactions will power the information networks of the future

A few months ago, I was playing around with chatGPT to test the limits of what it could do with the files I had on my computer. I had given it a bunch of boring documents along with a simple prompt, “analyze this for me”. Excel files. Blood test results. Tax forms. Each time, I got a fairly straightforward breakdown of the document. Then, I happened to notice on an email notification in the right corner of my screen I had just gotten from my credit card. “Your statement is ready to view”. Whatever, I thought, about to ignore it like usual. But reflexively, I moved my cursor. I tapped on the email and briefly looked at the dozens of the raw transaction line items in the attached PDF. Without a second thought, I dragged the statement into my chatGPT window and tweaked my prompt:

The response floored me. With just a simple list of transactions, the model was able to paint a picture of my behavior that was shockingly accurate. It presented a bio of me that wasn’t artificially manufactured or perfectly curated. It was real. And it was built on the foundation of powerful data that has for years been hidden in plain sight: transactions.

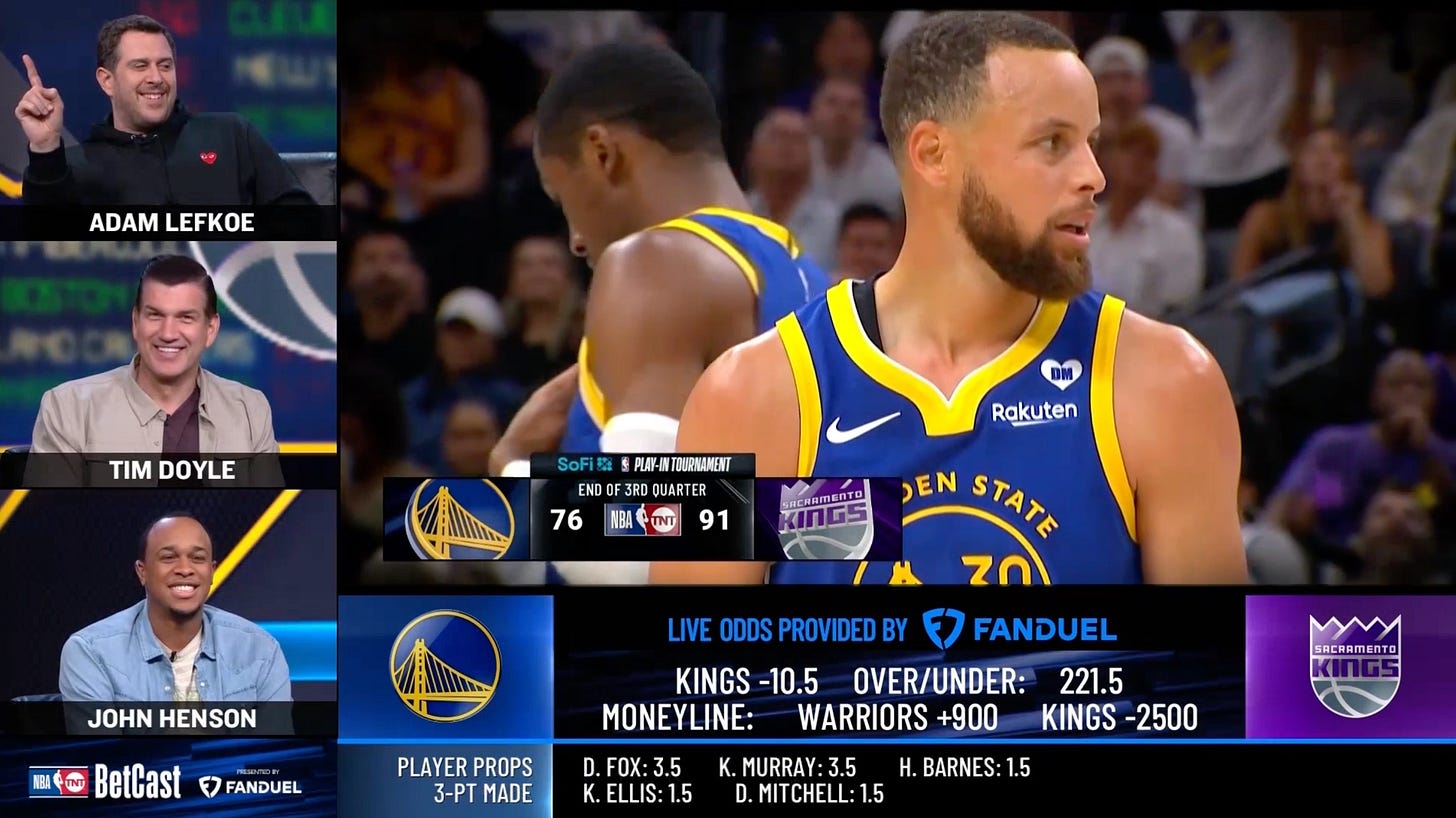

As a lifelong sports fan, most of the debates and conversations I had growing up with friends had always been “vibes-based”. The Lakers are going to blow out the Suns tonight because they’re way better. There’s no chance the 49ers make the playoffs. Klay is gonna go off tonight. When we had these conversations, there was no incentive to be precise. And actually, the more extreme your argument and louder you were, the more attention you were rewarded with. This vibes-based discourse was inherently sloppy, and couldn’t accommodate enough of a skill-gap to separate the true fans from the casuals.

The onset of sports betting changed that. There was now an incentive to actually know what you were talking about. As a fan, seeing the odds meaningfully told you what to look for in a game. The social conversation turned from nebulous pontification and vibes to truth and reality.

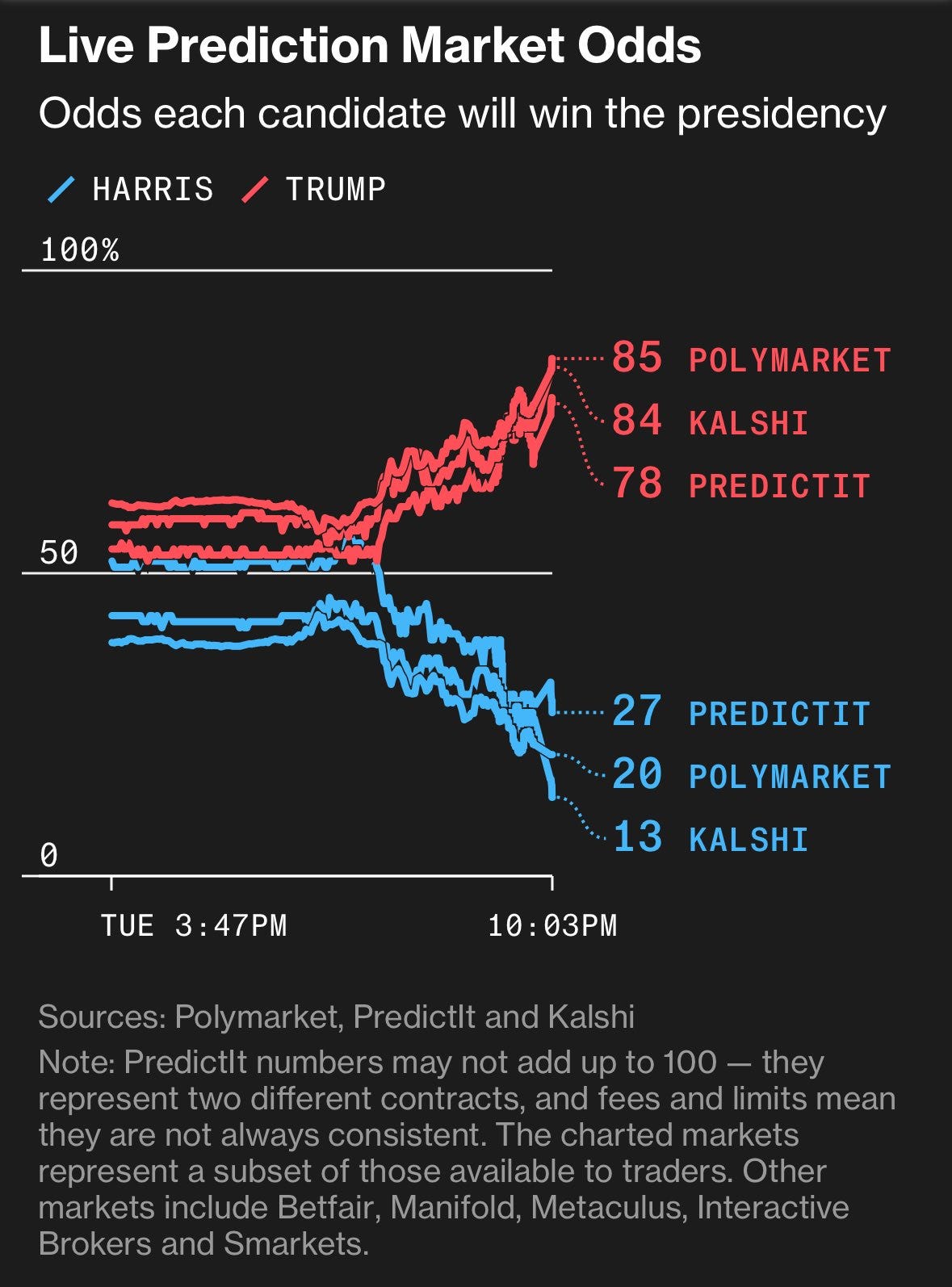

One such turning point crystallized on the night of November 5, as Donald Trump took back the White House and became the 47th president. It was a transformative election cycle for many reasons, but perhaps most importantly, it marked a revolution in our cultural perception of betting markets as mainstream information sources. While traditional media channels, pundits, and legacy networks consistently portrayed the election as a tight race, prediction markets saw the truth more clearly. They forecasted a big Trump victory before anyone else and delivered a stunning repudiation to establishment media sources.

However, prediction markets still only scratch the surface of the much wider concept of information finance. Today’s prediction markets - due to both technical and distributional challenges - are still limited in their impact and ability to draw mass participation. If prediction markets currently represent an emerging, info finance-based alternative to traditional “news”, then analogously, I believe there’s ample opportunity to build a new type of info finance-based alternative to traditional “social networks”. In other words, if prediction markets today represent the information finance version of CNN or CNBC (central destinations where people go to consume macro information), then what does the information finance version of X or Instagram look like (large, UGC networks with long-tails of content & p2p interaction)?

I believe it takes the form of a product where users can share their transactions as a form of “proof of work” that they did something. What betting - and more broadly the democratization of market access to retail consumers - has done in recent years is to introduce money as a driving force for reality-grounded conversations about sports, culture, and more. Downstream of this trend is a core thesis I have for the future:

Transactions are the foundational unit for tomorrow’s information networks.

At its core, money is information. Today, we have massive, global networks for sharing so many types of information. It’s super easy to share what you’re looking at in the form of a photo or video. It’s lightning-fast to broadcast your thoughts to anyone on the planet. Hell, you can even share your running workouts and resting heart rate, most intimate dating preferences, and the songs you’re listening to. Networks built atop atomic units of what we would consider “traditional” content mediums have been exhausted. However, when it comes to money, such tools for open sharing & broadcasting are either nonexistent or primitive.

Why is this? The simplest explanation is that historically, talking about money has been taboo. It’s naturally a more abrasive medium than a photo or status update. However, for the reasons I’ve talked about above, it feels like the cultural tides are changing; talking about money is in vogue. Another explanation is that technically, there hasn’t been a great way to synthesize and share transaction-based data. The advent of large language models changes that (more to say on this in a future post). And while there have been passing attempts by P2P payment companies at turning transactions into content in the past, they’ve been structurally flawed. There’s a difference between messaging and broadcasting. For the same reasons you wouldn’t share your texts publicly, people don’t like sharing their P2P payments. But that doesn’t mean that people want to keep all their spending private. There’s a reason that Twitter initially exploded as a public broadcasting-based evolution of SMS texting. And I believe a similar evolution will happen in payments. Furthermore, I strongly believe that in an increasingly digitally-native world, where the internet is the prime layer of reality, anything that can be shared, will be shared. This isn’t a good or bad thing. It’s simply a circumstance of the tendency for information to want to be free. And at a societal level, the flow of money represents perhaps the most unadulterated form of information transmission that exists; one that will become critically important in the next decade.

Right now, we’re at an existential digital inflection point. With the rate of exponential improvement in AI models, It’s becoming scarily easy to generate any kind of hyperrealistic content & proliferate this synthetic information across the world instantaneously. While such tools are undoubtedly helpful for boosting the creativity and productivity of the average human, there are also certain pitfalls to be aware of. Namely, it’s harder than ever to discern the “truth”. Our grip on reality is slipping, and in an age where “seeing is believing” or “pics or it didn’t happen” doesn’t cut it, we need new measures of gauging what’s true.

Money serves a role as a new grounding source of information. Transactions are real - they’re a form of information transmission grounded in what’s really happening in the world. Everything someone does in life - every desire, every intent, every activity - has a price and a transaction associated with it. A packet of information with a built-in form of social proof. However, there’s no good medium to tastefully and effectively synthesize this information. How often do people get food delivery? Where’s the most popular place to get new sneakers? What streaming services do most people use? What are most people doing on Friday night? Which modes of transportation are most popular in this city? These are all questions that affect real people and need real answers.

The recent political transition has further accelerated the idea of large-scale transactional transparency. It’s been only a couple months since inauguration day, and DOGE has already revealed billions in government transactions that the public had no idea about. The key revolution here, in my opinion, is not that the new administration is cutting wasteful spending. It’s that, for the first time, we have radical visibility into the flow of transactions at a national level, and that information alone has massive value for our civilization. The more transactions that can be shared and treated as ground-truth information, the more power the public has in making decisions and being better informed about what’s really happening.

That’s why I’m building Perdiem, a new transaction sharing network. Perdiem is an iOS app that enables you to share your transactions easily, and control exactly what you want to share. Furthermore, you can explore what others are sharing to find out what’s really happening in the world. We’re starting out by enabling you to share credit card transactions, because that’s what most people use in their everyday lives. However, our long-term ambitions are much greater. We want to be a global network where you’ll be able to share, purchase goods and services, and trade information markets right within the app. We want to build the network that most accurately reflects reality. We have a ways to go to execute that vision, but I’m confident in the endgame.

Starting this week, we’re opening up more spots for people to test Perdiem. If you’d like to be part of the founding community and try out the app, fill out your name here and we’ll be in touch.

The timing has never been better to work on a product like this, and I’m extremely excited to build Perdiem to enhance reality.

Follow the money.